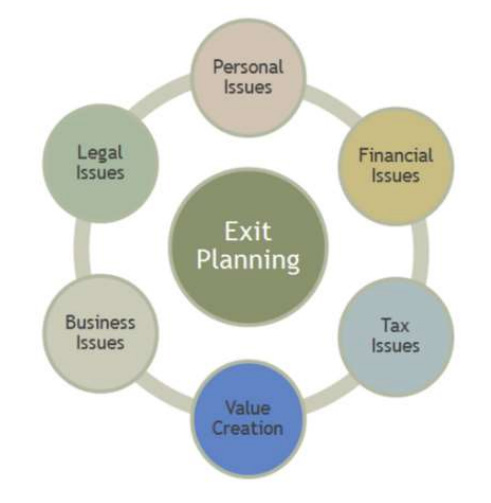

“An exit plan asks and answers all the business, personal, financial, legal, and tax question involved in

transitioning a privately owned business”.1

There is no one way to exit a particular business. Each business and its owner(s) have a unique set of

needs & wants. There are, however, several overlapping themes.

A CEPA (Certified Exit Planning Advisor) can help small business owners by “quarterbacking” a team of

professionals to assist the owner in the highly complex task of exiting their business. Often taken for granted

by many entrepreneurs, a planned exit reduces risk through a proactive plan of aligning the personal and

financial goals of the owner while maximizing value of the business over a period of a few – to several –

years.

Further, the Exit Planning Institute often refers to the process with the example of a three-legged stool – if

one or all are not in alignment then its usefulness may be compromised. The main themes are:

- Maximizing the value of the business

- Ensuring personal & financial preparedness

- Ensuring a plan for post-exit personal life

A properly constructed exit plan works towards making the timing of an exit irrelevant. A consistent effort

towards best-in-class performance reduces risks, gains efficiencies & effectiveness, which in turn add to

increased net income and valuation, which in turn fills in or completely eliminates the wealth gap most

owners discover they had when identifying their retirement needs. A CEPA assists in this area as well.

I work with organizations and their owners to build value in their organizations by examining the tradeoffs

between short term and long term return on investment – along with other tough decisions faced by today’s

business owner in an increasingly demanding marketplace.

Value often arises from variables that are not immediately quantifiable in today’s financial statements. For

more about how your business can benefit from Exit Planning please visit my LinkedIn profile.

Office: (414) 301-9696 email: Jason@StraightForward.today

Recent Comments