A key component to Value Acceleration is best-in-class performance

Financial KPI’s, or Key Performance Indicators, track progress within a framework that continually evaluates operational improvements. The continual, quarterly loop creates a roadmap to success.

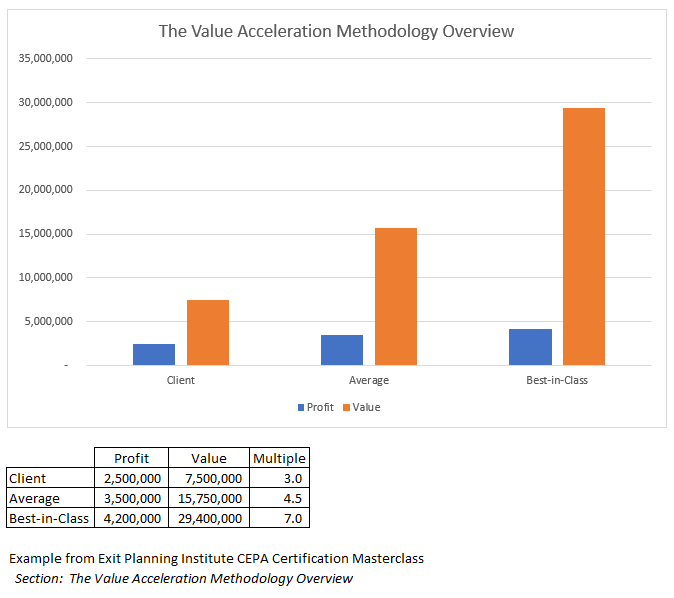

Best-in-class performance drivers simultaneously reduce risk while engendering value through business improvements. A leap in value is created when more profit makes its way to the bottom line – while with each planning cycle the business becomes more attractive to buyers, resulting in a higher value multipliers buyers are willing to offer for the business. In exit planning terms, this Profit Gap and Value Gap result in a non-linear equation to create the environment for leaps in value:

Each cycle closes with a grow-or-exit decision. Most owners choose to repeat the value acceleration process many times.

The most important point, however – I cannot stress this enough – is that through the Value Acceleration process owners have a realistic option to exit if they choose to. This option is priceless in situations where involuntary exits occur.

There is a saying in the industry – “transition ready businesses are more valuable”. Thus, Value Acceleration is “attached at the hip” with Exit Planning.

Value Acceleration begins with a baseline of what the business is worth, today. Take the first step in discovering what your business is worth by answering just a few questions by clicking [here]. Start making better decisions for your company and its growth, today.

Want to Learn More?

Learn how a fractional CFO can benefit your business by reaching out today