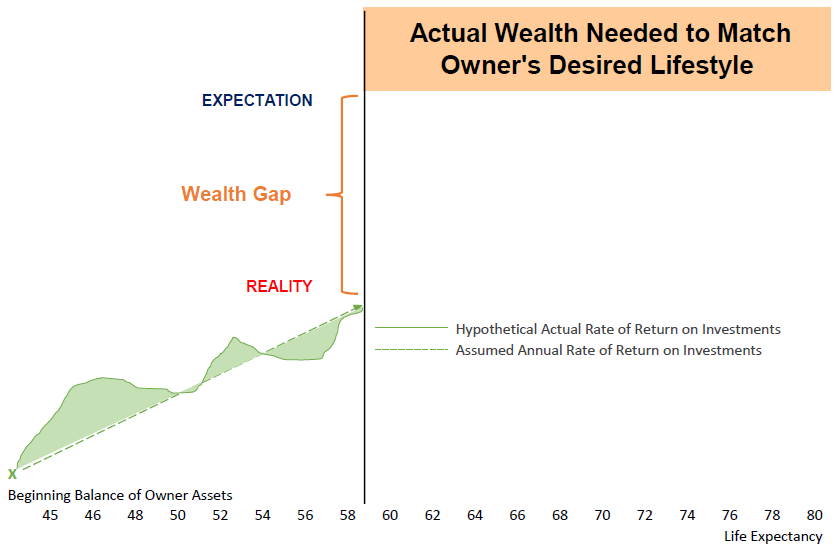

Most business owners have what is referred to as a “Wealth Gap”.

That is, the value to which the business owner’s business & investments will grow from now to planned retirement age are often distanced between reality and the expectation of what the owner requires to maintain their desired lifestyle.

The good news here is, the business is often the largest portion of the owner’s investment portfolio, and...

The business often is not running best-in-class and therefore has a “Value Gap”.

The Value Gap is addressed through the Value Acceleration process of Exit Planning.

Take the first step in finding out what your business is worth by answering just a few questions by clicking here. Start making better decisions for your company and its growth, today.

Want to Learn More?

Take the first step today and let’s close that Wealth Gap!