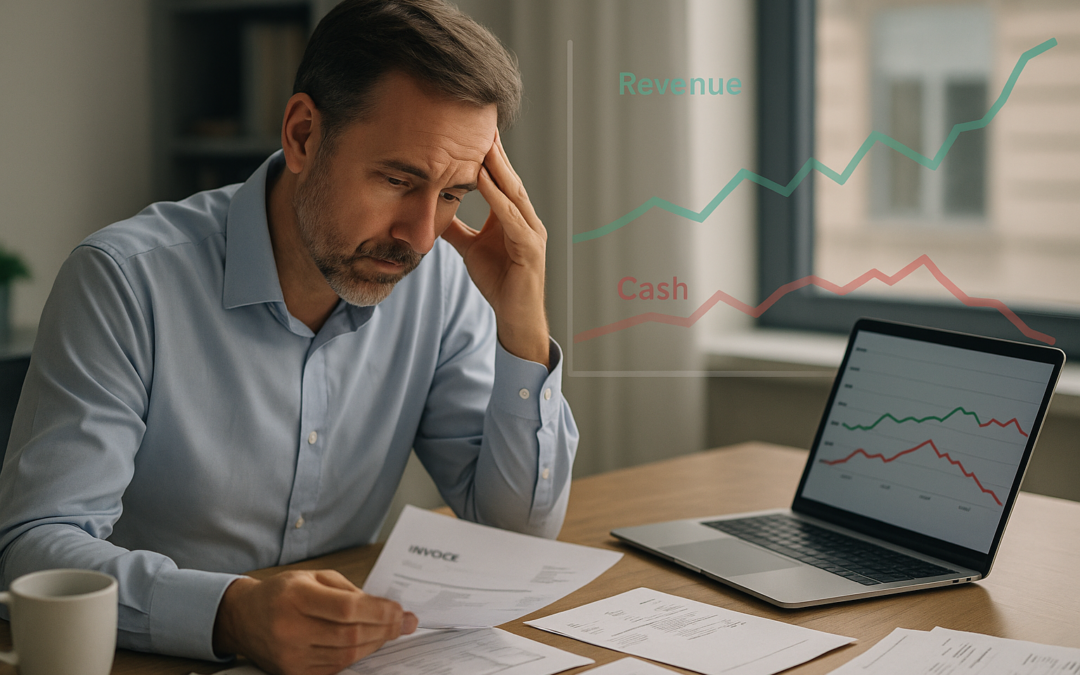

A few weeks ago, a new client came to us looking exhausted. Their sales had dropped 15% over the last two quarters — not catastrophic, but enough to make them nervous. Payroll was still high, inventory still full, and vendors still needed to be paid. But what really scared them wasn’t the dip in revenue. It was the cash drain they couldn’t explain.

They weren’t losing money in chunks — they were bleeding slowly, month after month.

The Slow Bleed That Every Owner Misses

Here’s what we found (and it’s what we see in most $1m–$10m businesses under stress):

1️⃣ Discounts That Erode Margin

When sales soften, many owners try to “get things moving” by offering discounts. But 10% off the top is often 30% off your gross margin. A short-term confidence boost turns into long-term profit loss and a lot of extra work.

2️⃣ Departments or Regions Operating Without Accountability

Many businesses grow faster than their financial visibility. A new region or division launches — but there’s no system to measure its own breakeven threshold.

Managers hit sales targets, but no one asks whether those targets actually cover their share of overhead.

That lack of visibility means an underperforming region can quietly drain company-wide cash flow for months before anyone notices.

Without regional P&Ls or clear contribution tracking, leadership can’t see which areas fund growth and which ones burn it.

3️⃣ No Accountability for Underperformance

When there’s no clear ownership of results, accountability dissolves.

If regional or departmental leaders aren’t held responsible for their financial outcomes — not just top-line sales — then cost overruns, poor pricing, or waste go unchallenged.

A Fractional CFO introduces financial scorecards for each unit: simple, consistent metrics that make accountability measurable.

It’s not about punishment — it’s about empowerment.

When managers understand their breakeven and contribution margin, they lead with confidence and make better decisions.

4️⃣ No Real-Time Visibility

Most small businesses rely on monthly statements that arrive 3–4 weeks late. By the time you realize you’re bleeding cash, you’ve already lost another month’s worth.

Why It Happens

When revenue dips, fear drives reaction instead of reflection. Owners double down on sales efforts, hoping more activity will fix the problem — but they skip the financial autopsy that reveals where the blood loss is happening.

The truth? It’s almost impossible to sell your way out of broken margins, inefficiency, or delayed collections. It’s like pouring racing fuel into a Yugo — no matter how premium the gas, the car is still not built to perform.

How to Stop the Hemorrhage

Here’s what we helped our client do in the first 30 days — and what any business owner can start doing right now:

✅ Map the Margin Leaks – Line by line, identify which products, customers, or regions are profitable — and which are quietly draining cash.

✅ Run a 13-Week Cash Forecast – It’s the difference between guessing and knowing. You can’t stop the bleeding if you don’t know where it’s coming from.

✅ Tighten Terms – Align vendor and customer payment timing. Incentivize faster payments. Negotiate breathing room where you need it most.

✅ Freeze Non-Essential Spend – Pause all “nice-to-haves” until you stabilize. Then reintroduce what truly adds value.

✅ Rebuild Confidence with Clarity – Once the leaks are visible, the anxiety eases. Financial clarity replaces fear.

How a Fractional CFO Stops the Slow Bleed Before It Starts

A Fractional CFO brings objectivity and discipline to the moments when emotions usually take over. They translate financial chaos into a plan — one you can act on confidently.

For this client, we:

-

Built a rolling 13-week cash flow forecast

-

Created regional P&Ls for clear accountability

-

Repriced unprofitable product lines

-

Installed dashboards to track weekly cash and margins

Final Thought

Most businesses don’t fail because of one bad quarter.

They fail because they never notice the slow bleed until it’s too late.

If your sales have slipped and your cash balance feels thinner than it should, don’t wait for the crisis — find the leaks now.

We can help you do it in just 60 minutes.

Book your Cash Flow & Profitability Audit and take the first step toward financial stability.

Recent Comments